michigan gas tax increase 2021

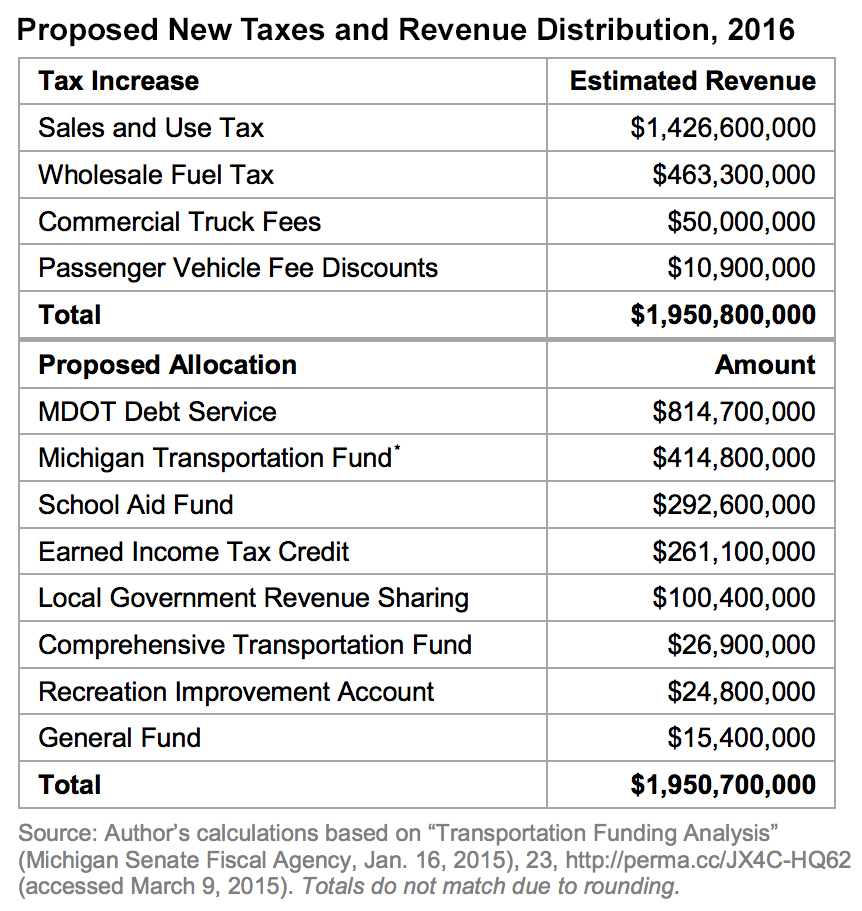

Motor Fuels Taxes include the Gasoline Diesel Fuel and Liquefied Petroleum Gas and Motor Carrier Fuel Taxes. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon.

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

The exact amount of the 2022 increase will depend on the inflation that occurs between Oct.

. 1 2020 and Sept. Gretchen Whitmer proposed a large tax hike. The current state gas tax is 263 cents per gallon.

The Michigan Public Service Commission today approved an 84173000 rate increase for DTE Gas Co. Alternative Fuel which includes LPG 263 per gallon. 1 2020 an action she said would raise more than 2 billion annually to fix.

LANSING Gov. Liquefied Natural Gas LNG 0243 per gallon. As of January of this year the average price of a gallon of gasoline in Michigan was 237.

Matt Helms 517-284-8300 Customer Assistance. Diesel Fuel 263 per gallon. Diesel Fuel 272 per gallon.

If by the end of September the annual inflation rate ends up similar to that of the previous six years the gas tax would rise from 263 cents to. 3 hours agoA woman parks to fill up her vehicles gas tank at a Mobil. Utahs gasoline tax saw a small increase in 2021 by 3 cents for every 10 gallons.

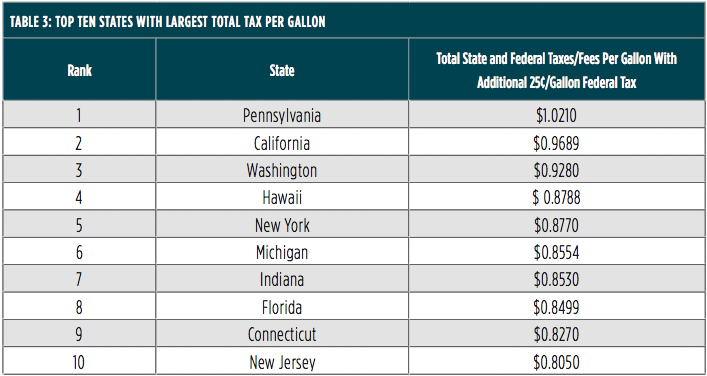

The totals include state and federal taxes. What state has the highest gas tax. It will have a 53 increase due to a rounding provision specified in the calculations.

Michiganders would be paying double the state taxes they currently pay at the pump. For fuel purchased January 1 2022 and after. When the gas tax increase kicks in just months from now Michigan residents will find themselves paying as much as 14 cents more per gallon.

Gasoline 263 per gallon. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct.

For fuel purchased January 1 2017 and through December 31 2021. 53 rows When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

Gasoline 272 per gallon. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as. AAA Michigan reports motorists are paying an average of 49 for a full 15-gallon tank of gasoline.

19 2021 at 928 AM PDT. Is Michigan gas tax going up. Michigan had the sixth-highest gas tax in the nation in January 2022 at 0641 per gallon.

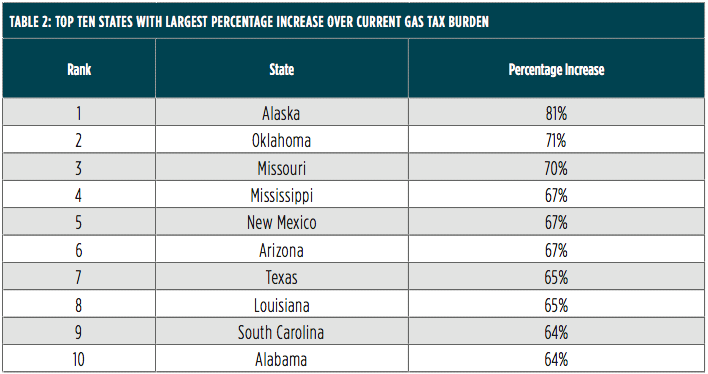

As such a 45-cent increase would bring Michigans total average gas tax to 8913 cpg by far the highest in the nation and over 30 cents higher than in Pennsylvania which currently has the highest gas tax 587 cpg. It will have a 53 increase due to a rounding provision specified in the calculations. WILX - Michigan gas prices are now at a new 2021 high after an increase of nine cents from last week and could remain high for awhile according to experts.

What state has the highest gas tax. In 2021 at a total of just over 45 cents combined per gallon Michigans gas tax was among the highest in the country at number 9 according to kiplinger. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov.

In 2021 at a total of just over 45 cents combined per gallon Michigans gas tax was among the highest in the country at number 9 according to kiplinger. Michigan Gas Tax Increase on Audacy. This reflects an increase of about 10 from January 2020 when Michigans statewide average price.

0183 per gallon. To repeal an annual state gas and diesel tax increase based on the inflation rate for the past year which was imposed with a general increase in these taxes in 2015. The Salt Lake Tribune calculated that would amount to about.

FOR IMMEDIATE RELEASE Dec. Talking Michigan Taxes. Referred to the House Tax Policy Committee on November 30 2021.

Steven Johnson R on November 30 2021. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent. 4198 cents per gallon 140 greater than national average 2021 diesel tax.

So far in 2021 inflation has been unusually high. Official Text and Analysis. Federal excise tax rates on various motor fuel products are as follows.

WILX - Michigan gas prices are now at a new 2021 high after an increase of nine cents from last week and could remain high for awhile. The new Michigan fuel levy which would be the states first increase since 1994 will be collected on top of an 184-cents-per-gallon federal gas tax. The rates approved today include 38 million for an infrastructure surcharge previously.

The current state gas tax is 263 cents per gallon. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as.

A 45-cent tax increase per gallon of gas. An analysis in June by the nonpartisan Tax. 4318 cents per gallon 141 greater than national average.

Michigan At Significant Risk Of A 2021 Tax Hike Mackinac Center

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Michigan Gas Tax Going Up January 1 2022

Michigan S May Tax Proposal Mackinac Center

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan S May Tax Proposal Mackinac Center

Resident Information Ottawa County Road Commission

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

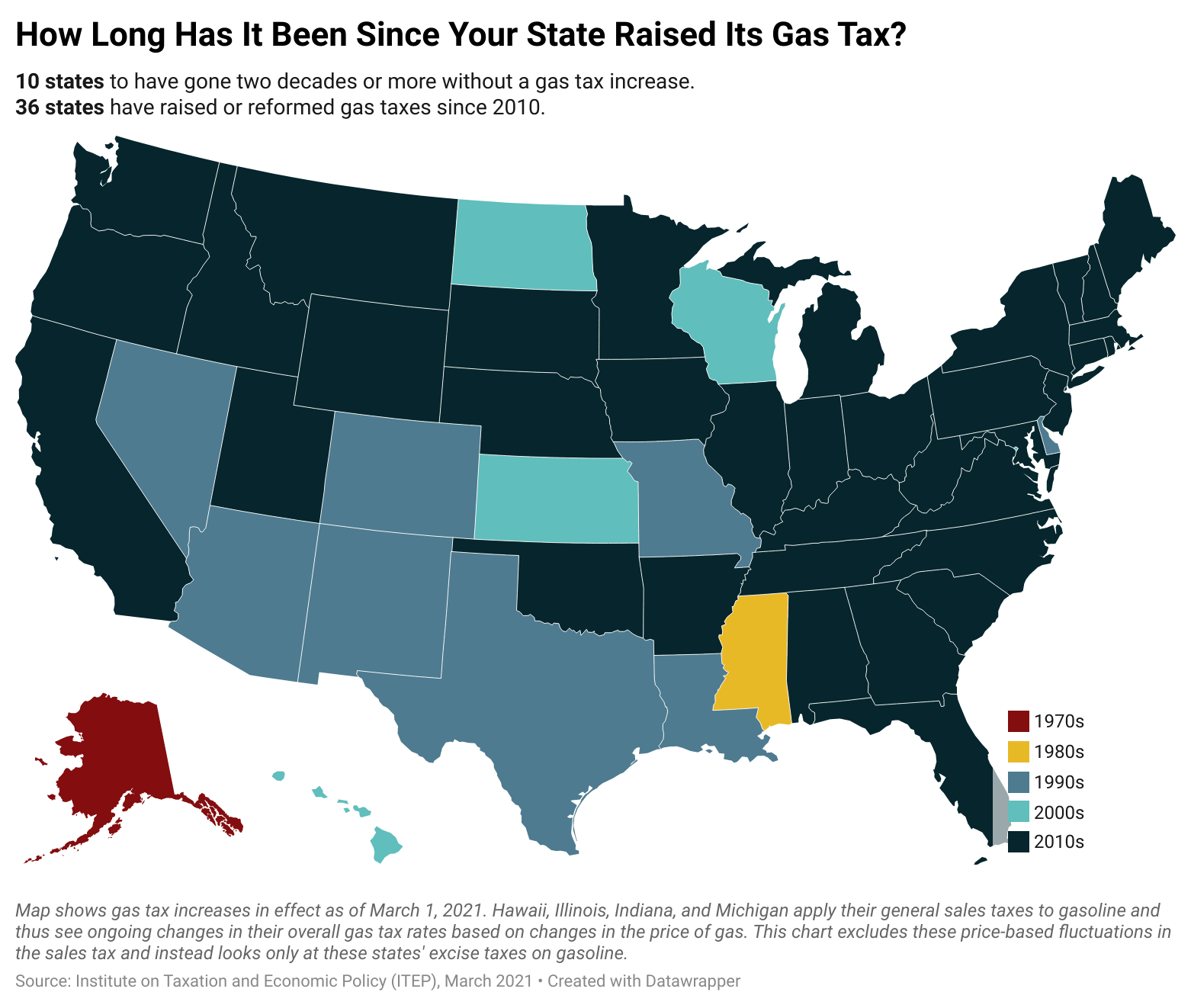

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

Every American Stands To Lose Under Unprecedented Gas Tax Increase

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Every American Stands To Lose Under Unprecedented Gas Tax Increase

What Does An Additional Penny Of Gas Tax Buy Bridge Michigan

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

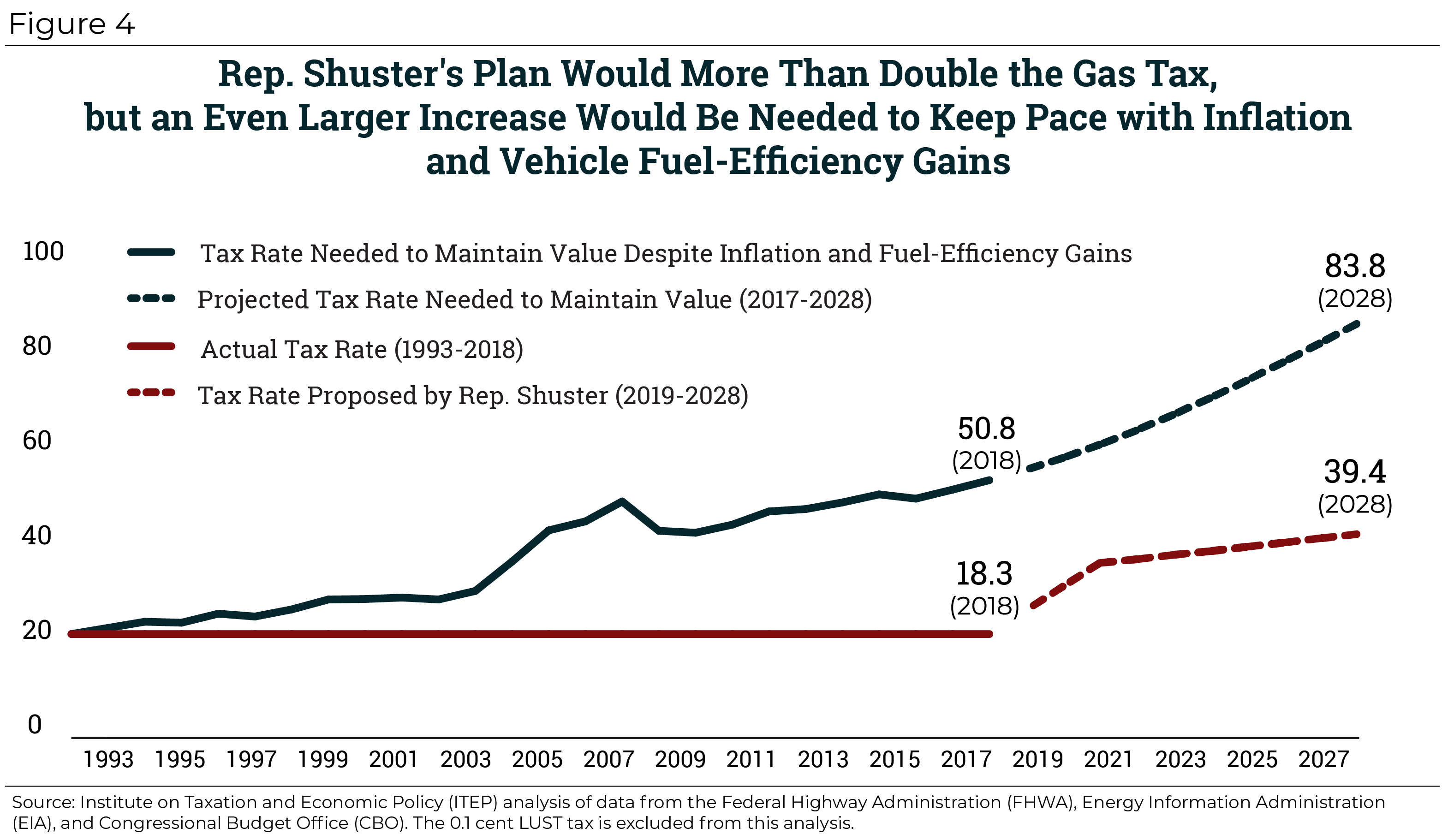

Rep Shuster S Mixed Bag Doubling The Gas Tax Before Repealing It Entirely Itep